Dynamics 365 Finance

At Covenant Technology Partners, we understand that every organization has unique financial and operational needs. With Covenant, you’re not just adopting a cloud ERP system; you’re partnering with a dedicated team that integrates your end-to-end operations. Our goal is to empower you with real-time insights and AI-driven analytics to enhance unified financial management and build a resilient, optimized supply chain. With our customized approach, you’ll be ready to respond to rapidly shifting market demands and manage your business with data-driven decision making and global business operations.

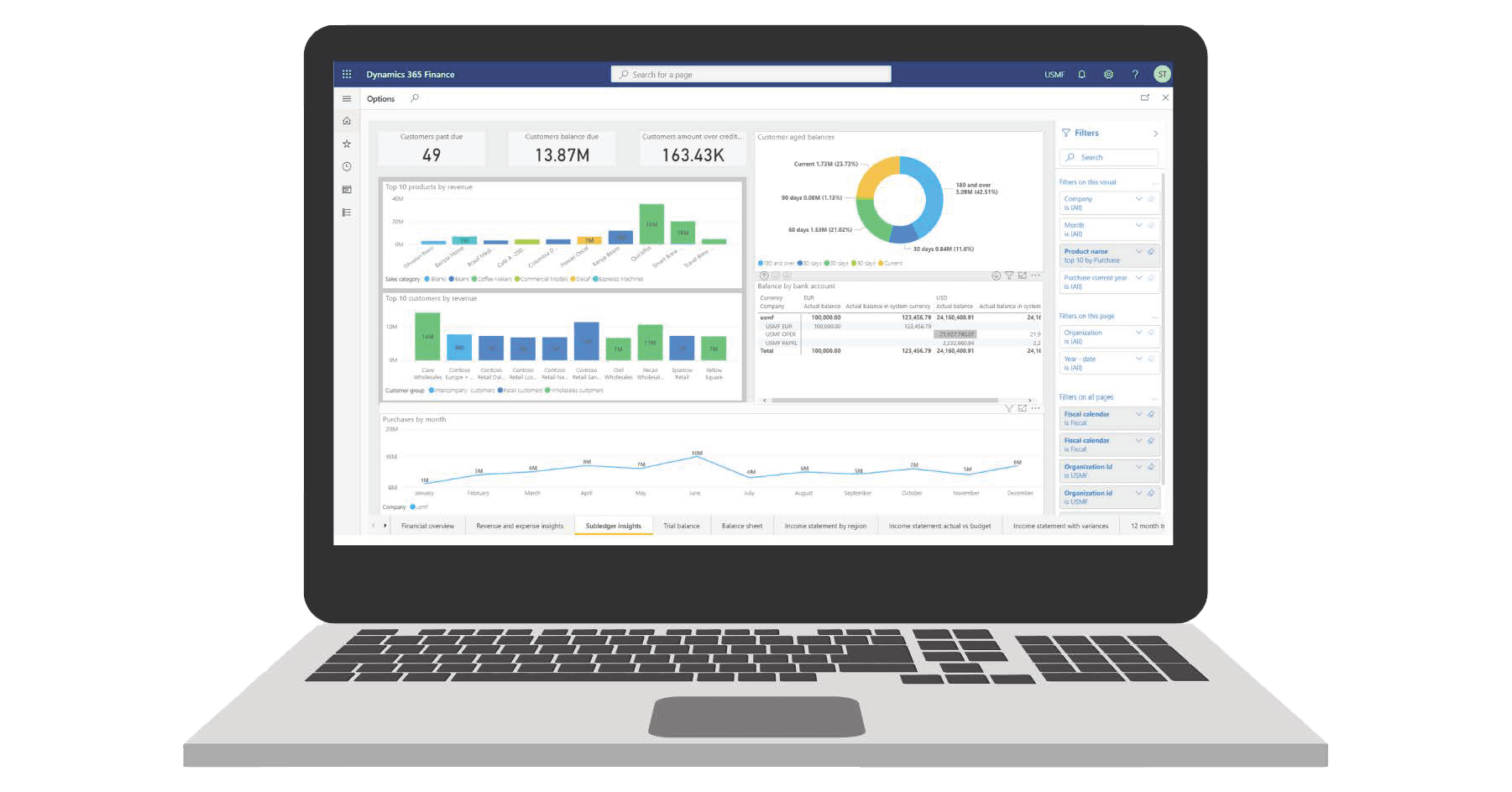

Explore the Powerful Features of Dynamics 365 Finance

Financial Strategy and Analysis

Boost agility with comprehensive financial planning, budgeting, and forecasting, supported by AI-driven insights. Leverage advanced tools to create dynamic financial plans, accurate budgets, and reliable forecasts. Enhance your business performance with intelligent recommendations and real-time data analysis.

Swift Accounting and Close Processes

Accelerate financial close and reporting with automated processes and intuitive analytics. Streamline your accounting operations with automation and self-service analytics. Ensure timely and accurate financial reporting, reducing the time and effort required for closing periods.

Integrated Tax Solutions

Simplify tax compliance with unified data models for managing jurisdictions, rates, and deductibility. Manage your tax obligations efficiently with a centralized system that handles multiple jurisdictions, tax rates, and deductibility rules. Ensure compliance and accuracy in your tax reporting.

AI-Driven Billing and Collections

Maximize revenue with AI-enhanced billing, accounts receivable, collections, and more. Transform your monetization strategies with intelligent billing solutions, efficient accounts receivable management, and proactive collections. Utilize AI to optimize every step of the quote to cash process.

Predictive Liquidity Management

Manage liquidity effectively with predictive analytics and accurate cash-flow forecasting. Stay ahead of your cash management needs with tools that provide predictive insights and detailed cash-flow forecasts. Ensure your business maintains optimal liquidity levels at all times.

Data-Driven Performance Insights

Improve decision-making and agility with AI-assisted financial and operational analytics. Empower your team with self-service analytics that enhance both financial and operational decision-making. Utilize AI to gain deeper insights and drive agile business strategies.

Adapt to Changing Business Demands

Improve Decision-Making Abilities

Forecast Cash Flows Accurately

Monitor cash flow actively and identify trends with an intelligent forecasting solution. Stay ahead of your financial needs by using advanced tools to track cash flow and predict future trends, ensuring better financial planning and stability.

Predict Customer Payment Behavior

Reduce write-offs and improve margins by predicting when customers will pay their invoices. Utilize predictive analytics to anticipate customer payment patterns, helping you manage receivables more effectively and enhance your financial outcomes.

Simplify Budget Proposals

Save time and effort by using intelligent budget proposals to analyze historical data and create accurate budgets. Streamline your budgeting process with tools that analyze past data to generate precise budget proposals, reducing manual effort and increasing accuracy.

Accelerate Financial Close

Enhance financial management with support for foreign exchange, multi-currency, and entity handling in a single instance. Speed up your financial close process by leveraging flexible management tools that handle multiple currencies and entities efficiently.

Unlock Analytical Insights

Create reports, dashboards, and insights easily with business performance analytics to make informed decisions and optimize workflows. Empower your team with accessible analytics tools that simplify the creation of reports and dashboards, enabling better decision-making and operational efficiency.

Operational Automation

Streamline Invoice Processing

Reduce time and labor costs with Copilot in Dynamics 365 Finance, utilizing invoice capture (preview) to accelerate invoice workflows. Enhance efficiency by automating invoice capture and processing, allowing your team to focus on more strategic tasks while reducing manual effort and errors.

Manage Credit Risk and Collections Efficiently

Use Copilot to automate collections with rules and predictions, increasing on-time payments and enhancing cash flow. Leverage AI-driven tools to manage credit risks and automate collections, ensuring timely payments and better cash flow management while freeing up resources.

Consolidate Business Intelligence

Integrate data from Dynamics 365, Microsoft 365, and partner apps to create a unified source of intelligent information. Consolidate your business data into a single, comprehensive platform, enabling better decision-making and insights through a centralized intelligence hub.

Boost Growth, Reduce Expenses

Accelerate Business Expansion

Launch subsidiaries and products swiftly with entity cloning for rapid, cost-effective onboarding that adheres to best practices. Expand your business efficiently by replicating entity setups, ensuring quick and seamless integration of new subsidiaries and products while maintaining high standards.

Optimize Subscription Billing

Adapt to complex billing and pricing scenarios, gain actionable insights, and automate reporting with subscription billing solutions. Manage intricate billing processes effortlessly, leveraging advanced tools to provide insights and automate reporting, ensuring accuracy and efficiency in subscription management.

Boost Workforce Productivity

Automate tasks and prioritize fiscal work with Microsoft 365 integration and role-based workspaces. Enhance employee productivity by automating routine tasks and providing tailored workspaces that align with their roles, enabling them to focus on high-value activities.

Expand Your Reach Worldwide

Simplify Regulatory Compliance

Streamline tax calculations, electronic invoicing, regulatory reporting, and global payments with a guided chart of accounts. Ensure your business stays compliant with various regulations by simplifying complex processes through guided tools and automated workflows.

Achieve Global Compliance

Ensure adherence to regulations in 57 countries/regions and 67 languages with solutions from Microsoft AppSource for over 200 regions. Maintain global standards and meet local requirements effortlessly, leveraging a wide range of compliance solutions tailored to your needs.

Minimize Customization Needs

Create adaptable business documents using Microsoft 365 templates, avoiding costly and time-consuming code changes. Stay flexible and efficient by utilizing pre-designed templates that can be easily customized to fit your business requirements without extensive coding.

Promote Sustainability

Monitor and reduce the environmental, social, and governance (ESG) impact of your systems and processes. Track your sustainability metrics and implement strategies to minimize your ESG footprint, contributing to a more sustainable business model.

Ensure Tax Compliance

Utilize a flexible tax-determination matrix and configurable tax-calculation formula designer to meet local tax regulations. Adapt to local tax laws with ease by using customizable tools that ensure accurate and compliant tax calculations.

Financial Management Capabilities

- Manages the core financial records of the organization, including chart of accounts, financial periods, and multi-currency support.

- Handles vendor relationships, purchase order processing, invoice matching, and payment processing.

- Manages customer accounts, sales orders, invoicing, credit and collections, and payment reconciliation.

- Oversees bank accounts, cash flow forecasting, electronic banking, and bank statement reconciliation.

- Tracks asset acquisition, depreciation, transfer, disposal, and revaluation.

- Facilitates budget planning, control, multi-year tracking, and forecasting.

- Generates financial statements, provides real-time insights, and ensures regulatory compliance.

- Supports automated financial consolidations to streamline month-end and year-end processes.

- Ensures a fast and agile financial close process to improve operational efficiency.

Project Management Accounting Capabilities

- Supports project creation, resource allocation, budgeting, and scheduling.

- Manages timesheets, expenses, procurement, and project progress tracking.

- Handles various billing methods and ensures compliance with revenue recognition standards.

- Tracks project costs, profitability, budget adherence, and cash flow forecasting.

- Facilitates collaboration through integration with Microsoft Project, Teams, and other D365 modules.

- Provides project performance dashboards, KPIs, customizable reports, and AI-driven analytics for data-driven decision making.

- Enables business process automation for improved project execution and management.

Client Benefits

- Global scalability: Respond quickly to enhanced growth with an organization or new company.

- Unified and Centralized Data: Having data native to one system allows users to stay connected and access the data pertinent to their role or function.

- Eliminate Peripheral Systems, Reduce Cost: Reduce or eliminate service and support fees by having internal teams manage the solution.

- Future-ready ERP: Stay ahead of market changes with a system that evolves with your business.

- Global business operations: Manage complex, cross-border activities with ease through unified, integrated business processes.

- Power Platform Integration: Achieve seamless Power BI integration along with other Microsoft solutions to enhance reporting and gain deeper insights into your business operations.

Client Case Studies

Dynamics 365 Finance Blogs

Introducing the Customer Balance Statistics Deletion Job in Dynamics 365 Finance & Operations!

What's new or changed in Dynamics 365 Finance 10.0.40 (June 2024) We are thrilled to announce a new feature in Dynamics 365 Finance & Operations (D365 F&O) designed to help you manage your data more effectively and maintain optimal system performance: the...

Dynamic Cash Flow Management

Dynamic Cash Flow Management is a cutting-edge feature designed to empower organizations with real-time insights and control over their cash flow. By leveraging advanced forecasting algorithms and predictive analytics, Dynamic Cash Flow Management enables...

Introducing: Advanced Cash Management

We understand the critical importance of managing cash flow effectively for businesses of all sizes. That's why we're excited to announce the launch of Advanced Cash Management, a powerful new feature designed to provide you with greater control and visibility over...

- « Previous

- 1

- 2

- 3

- 4

- Next »

SOLUTIONS MADE FOR YOU

Want More Information?

Contact us today to discover how our Dynamics Finance consulting services can help you achieve your financial and operational goals. Whether you need to improve your agile financial close, streamline tax reporting, or optimize your global business operations, Covenant Technology Partners is here to provide the right solutions for your evolving needs.